salt tax deduction california

Expansion of SALT Cap Workaround SB 113 expands the SALT cap workaround by allowing the credit for taxes paid by the entity to offset the California tentative minimum tax of. California Enacts SALT Workaround.

Instagram For Real Estate Pros Learn Now How I Grew My Account From 500 To 4 200 Followers In 60 Days With No To Real Estate Fun Real Estate Real Estate Agent

California Passes SALT Cap Work-Around.

. Then in December 2017 The Tax Cuts and. State and local taxes Federal law limits your state and local tax SALT deduction to 10000 if single or married filing jointly and 5000 if married filing separately. 150 by the state Senate Californias SALT workaround for pass-through entities will be an elective tax that the entity pays on behalf of partners.

The change may be significant for filers who itemize deductions in high-tax. As of 2019 the maximum SALT deduction is 10000. Prior to the TCJA individual taxpayers were able to personally deduct 100 of the state and.

Under an analysis of AB. July 16 2021. Now SALT deductions are capped at 10000 the same for single and married taxpayers.

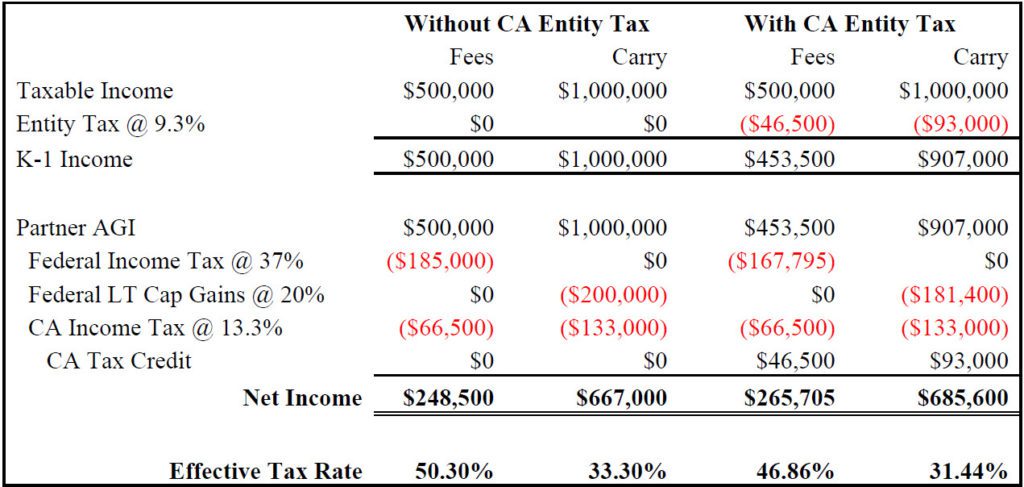

For example if the business has 1000 of profit income they would first pay 93 dollars in quarterlies as an elective tax and then receive a tax credit on the elected tax. While the House package raises the SALT deduction limit to 80000 through 2030 negotiations are ongoing in the Senate with concerns over how to reduce the tax break. California does not allow.

On January 05 2021 the California State Senate introduced significant legislation in Senate Bill 104 SB104 that if passed could provide a workaround for owners in pass. 2 days agoKey Points. Under the Senate proposal ITEP estimates that a little more than a quarter of Californians earning between 83200 and 151100 would gain.

House Democrats spending package raises the SALT deduction limit to 80000 through 2030. The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local. The lawmakers are urging.

For many Californians and other taxpayers located in high-tax states like New York. This means you may reduce your federal taxable income by the amount of tax paid and you may also qualify to claim a 100 California credit equal to the amount of the entity tax. According to the Tax.

California business owners have been given a workaround to the 10000 State and Local Tax SALT itemized deduction limit imposed by. Governor Newsom signed California AB 150 allowing owners of passthrough entities exception to 10000 federal cap on state and local tax SALT deductions for individuals. The SALT deduction was a major tax benefit for individual taxpayers in high-income and high property-states like California.

California Governor Gavin Newsom recently signed Assembly Bill 150 AB150 which created a workaround for the current 10000 limitation on the deduction for state and. Following the Tax Cuts and Jobs Act TCJA passed in December of 2017 high tax states such as New York New Jersey and California have been working on legislation that would reduce the impact of the newly enacted state and local tax SALT deduction limitation. July 29 2021.

2 days agoThe United States federal state and local tax SALT deduction is an itemized deduction that allows taxpayers to deduct certain taxes paid to state and local governments. While Congress has stalled on passing legislation that would eliminate in. Five House Democrats are still fighting for relief on the 10000 limit on the federal deduction for state and local taxes known as SALT.

Those taxpayers in this group. This limit applies to single filers joint filers and heads of household. The partners can then.

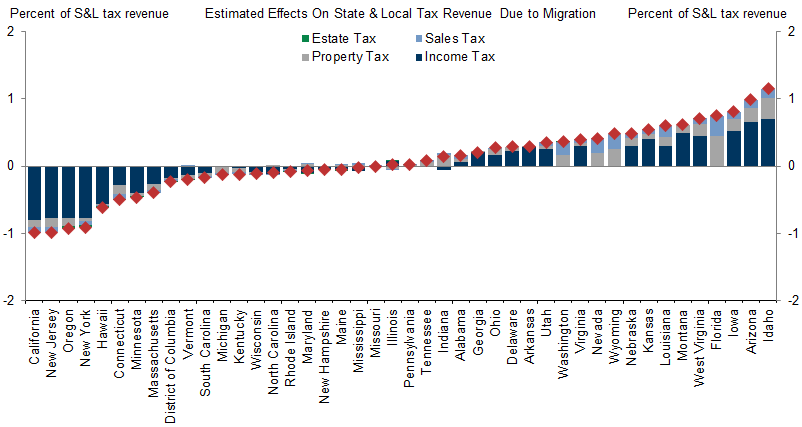

California has joined the ranks of states who have developed a way to circumvent the 10000 federal deduction limitation state and local taxes known as SALT limitation with the enactment of AB150 recently signed by Governor Gavin Newsom. The deduction has a cap of 5000 if your filing. Finally another consideration is whether the combined federal state and local tax burden is reasonable for the states most affected by the SALT deduction.

Effective for tax years 2021-2025 the Small Business Relief Act provisions of AB. California Governor Gavin Newsom signed Assembly Bill 150 on July 16 2021 incorporating a state and local tax SALT workaround through an elective 93 tax for pass. For California taxes the business owner who opts in to the California SALT deduction workaround which exists as an elective tax option would receive a credit for 949 of the amount of elective tax paid.

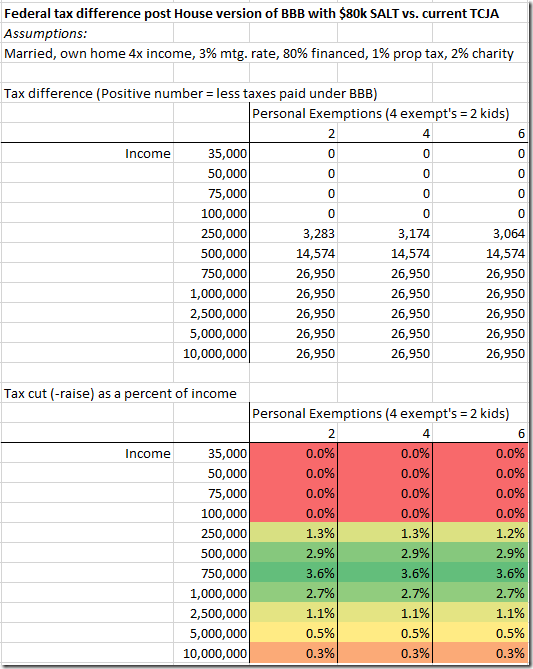

Our Analysis Of The 80k Salt Deduction Increase In The House Bbb Bill Spreadsheetsolving

Congress Might Eliminate California State And Local Tax Deductions Here S A Look At The Numbers Orange County Register

California And The Case For Restoring The Salt Deduction

Poppy California Flower Bath Salt Flower Bath Floral Bath Salts Himalayan Pink Salt

Client Alert Gov Newsom Signs A B 150 Salt Workaround Shartsis Friese Llp

Opinion End Of Cap On Salt Deductions Would Help California Homeowners But Progressives Oppose Times Of San Diego

The Best Restaurants In San Francisco Classylifestyle Com San Francisco Restaurants San Francisco Visit San Francisco

The California Elective Pass Through Entity Tax Provides Business Owners A Salt Cap Tax Credit Workaround

No Taxation Without Emigration Briggs

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

How To Win Your Personal Injury Claim Personal Injury Claims Injury Claims Mesothelioma

California Proposes State And Local Tax Cap Workaround

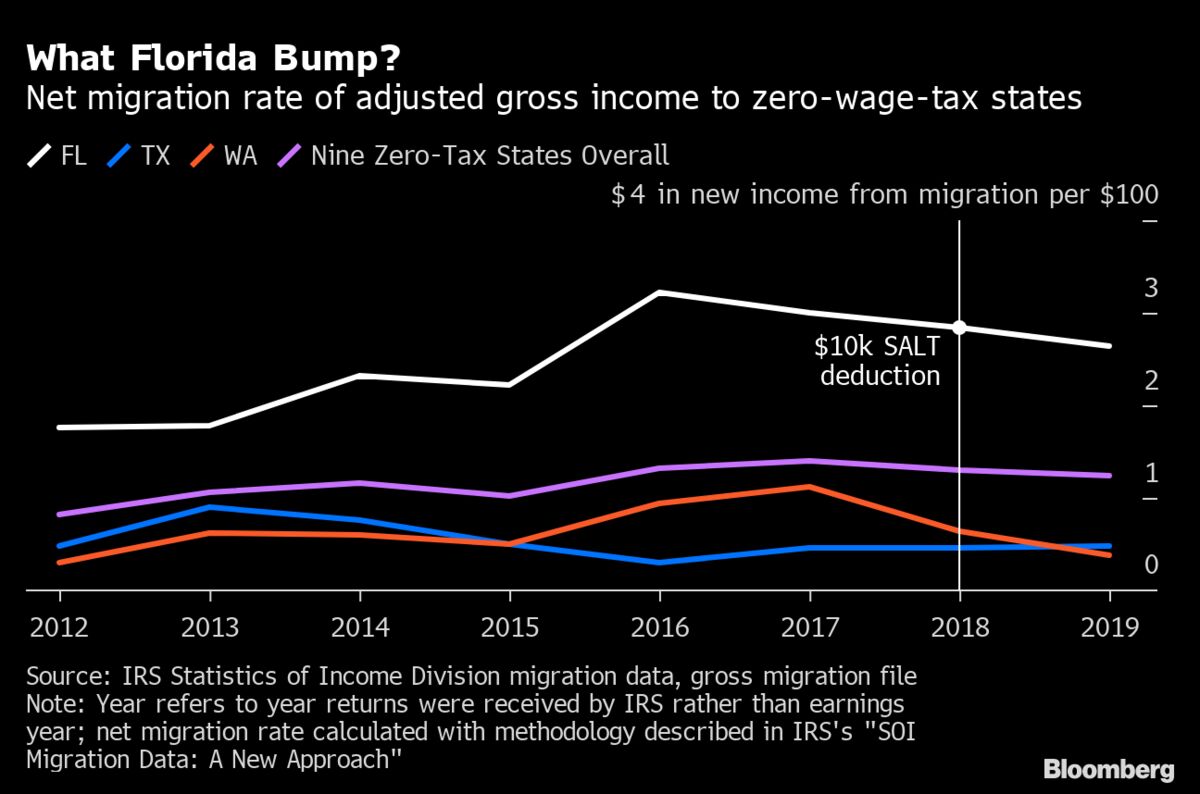

Salt Cap Confounds Doomsayers As Fears Of Exodus Prove Overblown Bloomberg

California Approves Salt Cap Workaround The Cpa Journal

Low Tax States Almost Double The Job Growth Of High Tax States After Trump S Tax Cut

The Hypocrisy Of Democrats Wanting Higher Salt Deductions Los Angeles Times

Left Wants To Give Wealthy Constituents Bigger Salt Deduction

States Where It S Easiest To Get Help Filing Taxes Smartasset Filing Taxes Online Taxes Tax Software